Left Menu

Bazaar Loan

Bazaar Loan

-

Funds for small entrepreneurs to finance working capital needs such as purchase of raw materials, salary payments, power charges, etc.

-

Loan amount – Minimum ₹26,000; Maximum ₹1.5 lakh

-

Loan tenure – 1 year/2 years

-

Simplified documentation for hassle-free loan processing

-

Doorstep documentation and delivery

-

Use of tabs with biometric authentication at doorstep to speed up transaction time

-

Timely disbursement

**Obtaining insurance offered by the bank is non-mandatory for availing any EEB loan product.

Current Interest Rate: 22.45%

Processing Fee:

-

For loans up to ₹50,000: Nil

-

For loans > ₹50,000: 1.25% + GST

Click here for Mean Interest Rate.

-

Existing Super Saver depositors who have fixed place of availing services

- One latest passport size photograph

-

Address and identity proof documents

-

Documents acceptable as proof of identity and address (for domestic individual Savings Accounts) - opening of accounts/address change/periodic updation of KYC (Re-KYC) are:

-

Proof of Possession of Aadhaar number

-

Passport

-

Driving Licence

-

Voter ID Card (Issued by Election Commission of India)

-

Job Card by NREGA duly signed by an officer of the State Government

-

Letter issued by National Population Registry confirming details of Name, Address

-

-

Only a single copy of the document is required if it is listed under both address and identity proof, e.g. Passport/Aadhar Card

-

If mailing address and permanent address are different, address proof documents for both are required

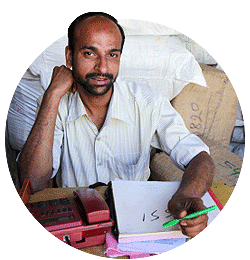

Get the support you need to expand your business

Apply for an MSME Loan from Bandhan Bank today

We will get in touch with you shortly