Left Menu

Shareholder's Information

This section inter alia provides information pertaining of the Company, its shareholding pattern, means of dissemination of information, service standards, share price movements and such other information, in terms of point no. C (9) of Schedule V to SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015 relating to Corporate Governance.

Shareholders / Investors Services:

GRUH has its in-house secretarial department under the overall supervision of Mr. Marcus Lobo – Company Secretary / Compliance Officer. For any assistance regarding share transfers, transmissions, change of address, non receipt of dividend, duplicate / missing share certificates and other matters pertaining to your shares, please write to the following address:

| Secretarial Department : | Registrar & Transfer Agent : |

|

GRUH Finance Ltd. Tel : 079 – 26421671-75; |

Link Intime India Pvt Ltd. Unit : “GRUH” 506-508, 5th Floor, Amarnath Business Centre-I Off. C.G.Road, Navrangpura, Ahmedabad- 380 009 Tel : 079–2646 5179 Fax : 079-2646 5179 E-mail :ahmedabad@linkintime.co.in |

Listing of Equity Shares :

GRUH’s shares are listed on the BSE Ltd. and National Stock Exchange of India Ltd.

The Stock Code Nos. are : BSE: 511288; NSE: GRUH

The listing fees have been paid to BSE and NSE for the financial year 2019-20 as per the listing agreement with the respective stock exchanges.

|

BSE Limited Tel. Nos. : +91 22-2272 1233/34 |

National Stock Exchange of India Limited |

Listing of Debt Securities:

GRUH’s NCDs (Series – SD-001 and SD-002 aggregating to ₹ 35 crores) are listed on the Wholesale Debt Market (WDM) segment of the National Stock Exchange of India Limited (NSE).

Debenture Trustees:

IDBI Trusteeship Services Limited, Asian Building, Ground Floor, 17, R. Kamani Marg, Ballard Estate, Mumbai – 400 001.

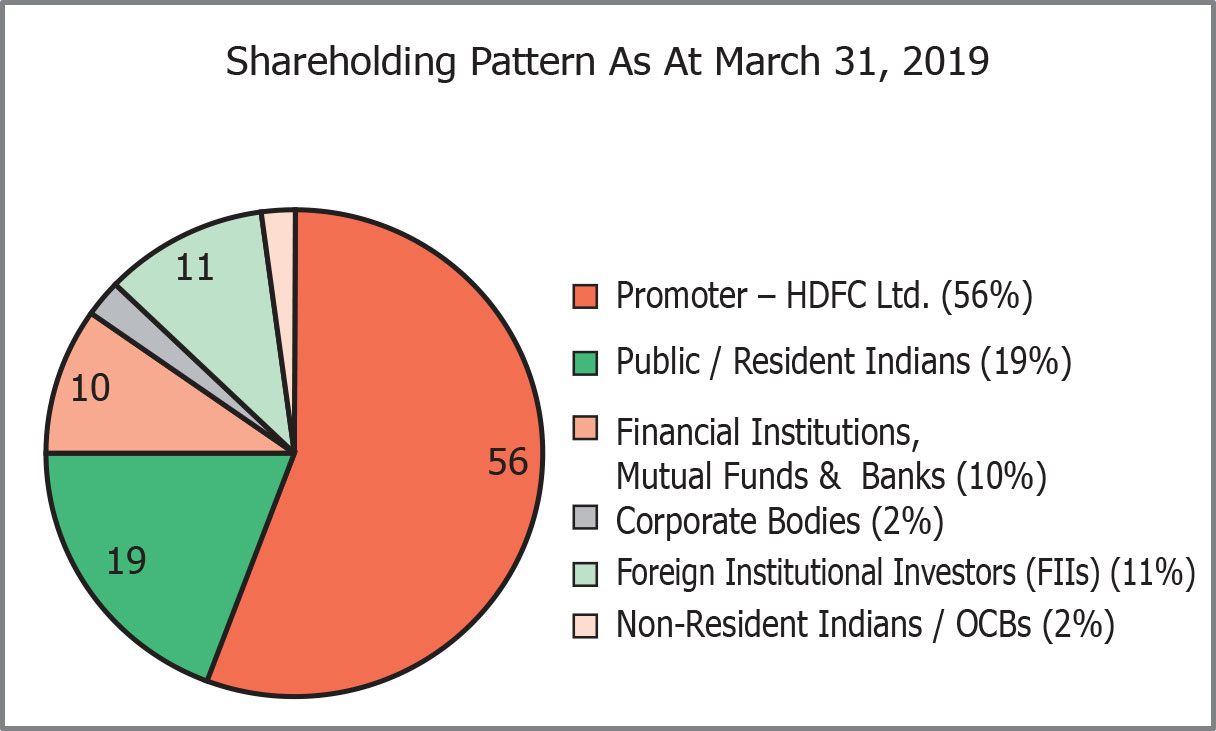

| Category | No. of Share-holders | Total No. of Shares Held | % to Capital |

| Promoter – HDFC Ltd. | 1 | 411555700 | 56.09 |

| Public /Resident Indians | 71707 | 138844497 | 18.92 |

| Financial Institutions, Mutual Funds & Banks | 61 | 71667341 | 9.77 |

| Corporate Bodies | 999 | 16968452 | 2.31 |

| Foreign Institutional Investors (FIIs) | 154 | 78913194 | 10.76 |

| Non-Resident Indians | 2978 | 15738328 | 2.15 |

| Total >>> | 75900 | 733687512 | 100.00 |

Distribution of Shareholding as at March 31, 2019

| No. of Shares held | Folios | Shares | ||

| Numbers | % | Numbers | % | |

| Upto 500 | 53801 | 70.88 | 6514501 | 0.89 |

| 501 to 1000 | 8588 | 11.31 | 6306476 | 0.86 |

| 1001 to 2000 | 5181 | 6.82 | 8129379 | 1.11 |

| 2001 to 3000 | 1988 | 2.62 | 5113116 | 0.70 |

| 3001 to 4000 | 1262 | 1.66 | 4578386 | 0.62 |

| 4001 to 5000 | 981 | 1.29 | 4646131 | 0.63 |

| 5001 to 10000 | 2174 | 2.86 | 15705982 | 2.14 |

| 10001 and above | 1925 | 2.54 | 682693541 | 93.05 |

| Total | 75900 | 100.00 | 733687512 | 100.00 |

Dematerialisation of Shares:

As at March 31, 2019, 98.99% of equity shares of GRUH have been dematerialised by shareholders through National Securities Depository Limited and Central Depository Services (India) Limited.

ISIN for NSDL & CDSL : INE580B01029

The status of shares which have been dematerialised and shares which are held in physical form as at March 31, 2019 are as under:

| Particulars | No of shares | (%) |

| Shares held in physical form | 7342332 | 1.01 |

| Shares held in electronic form | 726345180 | 98.99 |

| Total Shares | 733687512 | 100.00 |

Share Transfer System

In terms of Regulation 40 of the SEBI (LODR) Regulations, 2015, the Board of Directors has delegated the authority to approve share transfers to Mr. Kamlesh Shah (Executive Director) and Mr. Marcus Lobo (Company Secretary/Compliance Officer). Share transfer formalities are normally attended to three times in a month. The details of share transfers are reported to the Board of Directors.

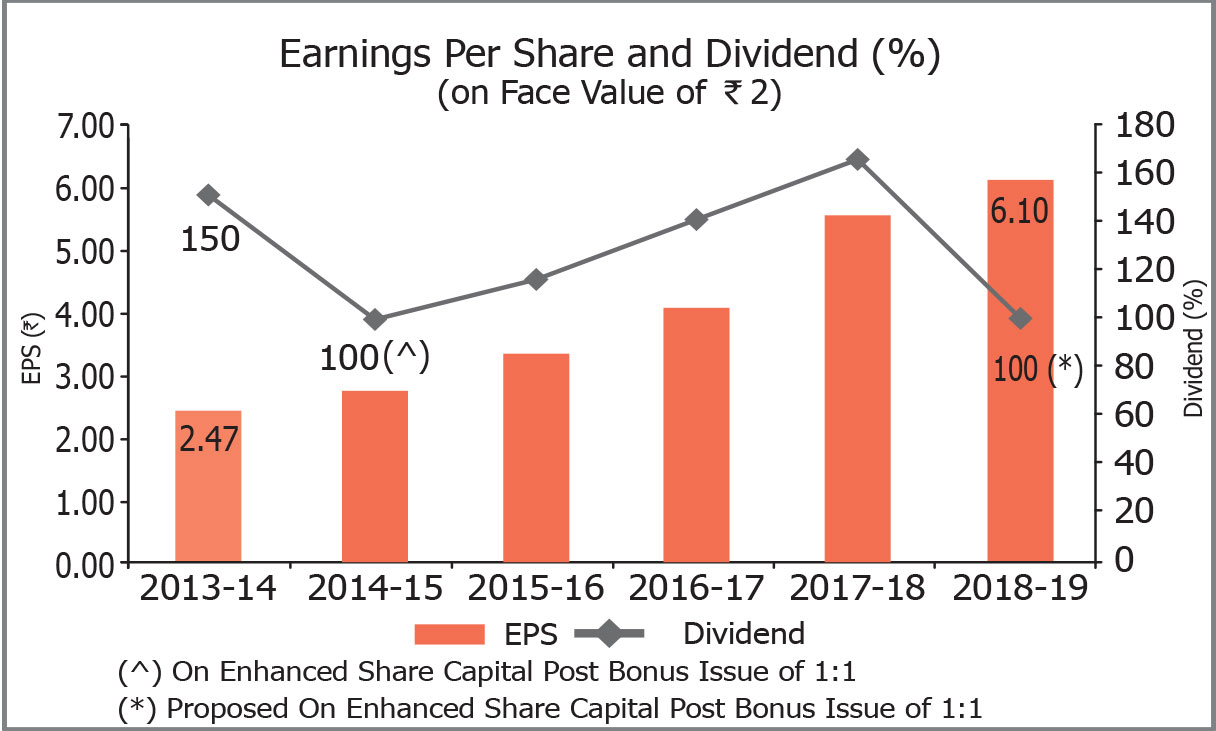

Details regarding dividend paid during the last 7 years :

| Year | Rate (%) | Book Closure Date | AGM Date | Payment Date |

| 2011-12 | 115 | June 8, 2012 to June 18, 2012 | June 18, 2012 | June 18, 2012 |

| 2012-13 | 125 | June 28, 2013 to July 8, 2013 | July 8, 2013 | July 10, 2013 |

| 2013-14 | 150 | May 7, 2014 | May 28, 2014 | May 28, 2014 |

| 2014-15 | 100 | June 18, 2015 to June 26, 2015 | June 26, 2015 | June 29, 2015 |

| 2015-16 | 115 | June 14, 2016 to June 22, 2016 | June 22, 2016 | June 22, 2016 |

| 2016-17 | 140 | June 7, 2017 to June 15, 2017 | June 15, 2017 | June 16, 2018 |

| 2017-18 | 165 | April 25, 2018 to April 27, 2018 | May 30, 2018 | May 31, 2018 |

NB: Shareholders who have not received the dividends may kindly contact the secretarial department.

Unclaimed Dividend

The Company has transferred all unclaimed/unpaid dividends up to the financial year 2010-11 to the Investor Education and Protection Fund, as applicable. The Company has transferred matured deposits and interest thereon for the year 2010-11 remaining unclaimed / unpaid, to the Investor Education and Protection Fund, in accordance with the current regulations.

Members who have either not received or have not encashed their dividend warrant(s) for the financial years 2011-12 to 2017-18 are requested to claim the unpaid dividend from the Company before transfer to the above mentioned fund. After transfer of unpaid / unclaimed dividend amount to the Investor Education and Protection Fund, the same cannot be claimed subsequently

Dividends that have not been claimed by the shareholders for the financial year 2011-12 will have to be transferred to the Investor Education and Protection Fund in August 2019 in accordance with the provisions of the Companies Act.

The details of the unclaimed dividend and the last date for claiming the same, prior to its transfer to the IEPF, are as under:

| Financial Year | No. of Members who have not claimed their dividend | Unclaimed dividend as on March 31, 2019 (₹) | Unclaimed dividend as % to total dividend | Date of declaration | Last date for claiming the dividend prior to its transfer to IEPF |

| 11-12 | 1028 | 17,18,731 | 0.42 | June 18, 12 | July 17, 19 |

| 12-13 | 1065 | 18,57,188 | 0.41 | July 8, 13 | Aug 5, 20 |

| 13-14 | 1155 | 23,13,68 | 0.43 | May 28, 14 | June 26, 21 |

| 14-15 | 1287 | 32,73,374 | 0.45 | June 26, 15 | July 24, 22 |

| 15-16 | 1167 | 33,12,646 | 0.40 | June 22, 16 | July 21, 23 |

| 16-17 | 1220 | 45,35,248 | 0.44 | June 15, 17 | July 13, 24 |

| 17-18 | 652 | 37,78,862 | 0.31 | May 30, 18 | June 28, 25 |

Unclaimed Shares:

As per Listing Regulations :

Regulation 39(4) of the Listing Regulations inter alia requires every listed company to comply with certain procedures in respect of shares issued by it in physical form pursuant to a public issue or any other issue and which remained unclaimed for any reason whatsoever.

In compliance with the provisions of the said Regulation, the Company has sent three reminders under Registered Post to the Shareholders whose share certificates were returned undelivered and are lying unclaimed. In case your shares are lying unclaimed with the Company, you are requested to claim the same by writing a letter to the Company

Last year, the unclaimed 3,81,250 equity shares of ₹ 2 each of the Company in respect of 303 folios were dematerialized and credited to GRUH Finance Limited – Unclaimed Suspense Account maintained with HDFC Bank Limited, on March 28, 2018, in compliance with the said Regulation.

During the year, As per the said provisions, GRUH had identified folios where shares had returned undelivered remaining unclaimed with the Company. Accordingly, GRUH had sent 3 reminder letters to the identified 231 shareholders and will be thereafter transferred identified equity shares to Unclaimed Demat Suspense Account opened with HDFC Securities Limited.

Summary of the unclaimed shares transferred to the said Unclaimed Suspense Account, in terms of the said Regulation, as on March 31, 2019, is detailed as under:

| Sr. No. | Particulars | No. of share holder | No. of equaity shares of ₹ 2 each |

| 1 | Aggregate number of shareholders and the outstanding equity shares lying in the Unclaimed Suspense Account as on March 31, 2018. | 303 | 3,81,250 |

| 2 | Aggregate number of shareholders and the outstanding equity shares lying in the Unclaimed Suspense Account after Bonus issue of shares*. | 303 | 7,62,500 |

| 3 | Number of shareholders who approached the Company for transfer of equity shares from the said Unclaimed Suspense Account during the year ended March 31, 2019. | 4 | 9,280 |

| 4 | Number of shareholders to whom equity shares were transferred from the Unclaimed Suspense Account during the year ended March 31, 2019. | 3 | 8,280 |

| 5 | Aggregate number of shareholders and the outstanding equity shares lying in the Unclaimed Suspense Account as on March 31, 2019. | 300 | 7,54,220 |

* The shares in unclaimed suspense account has increased due to 1:1 Bonus issue of equity shares in June 2018.

In terms of the said Regulation, voting rights on the equity shares lying in the said Unclaimed Suspense Account shall remain frozen till the rightful owner claims such shares. Further, all corporate benefits in terms of securities accruing on the said unclaimed shares viz. bonus shares, split, etc., if any, shall also be credited to the said Unclaimed Suspense Account.

As per Companies Act, 2013 :

As per Section 124 of the Companies Act, 2013, all shares in respect of which dividend has not been paid or claimed for seven consecutive years or more shall be transferred by the company in the name of IEPF. However, the concerned shareholder(s) can claim the dividend and/or shares that have been transferred to IEPF after complying with the procedure prescribed by the Ministry of Corporate Affairs, Government of India. The details of shares required to be transferred by the Company to IEPF is available on its website.

A brief outline of the procedure for claiming the dividend/shares from the IEPF Authority is listed for the benefit of the concerned shareholder(s):

- Download Form IEPF-5 from www.iepf.gov.in.

- Submit the duly filled form online at www.mca.gov.in. On successful upload, download the acknowledgement that gets generated automatically.

- Take a printout of the duly filled Form IEPF-5 and the acknowledgement. Submit the same to the Nodal Officer (IEPF) of the Company at its registered office in an envelope marked as “Claim for refund from IEPF Authority” along with the following documents:

– indemnity in original with claimant’s signature

– advance stamped receipt (in original)

– copy of Aadhaar Card (for Indian citizens)

– copy of Passport, OCI and PI card (for foreigners and NRI)

– proof of entitlement (share certificate/dividend warrant etc.)

– cancelled cheque leaf and

– Other required documents - The Company on receipt of the complete set of documents will submit its verification report to the IEPF Authority

- Upon submission of the verification report by the Company, the corresponding action shall solely be at the discretion of the IEPF Authority.

For more details, the concerned shareholders are requested to refer to the “Refund” section of www.iepf.gov.in.

Nomination Facility:

Where shares are held in single name, in case of an unfortunate death of the shareholder, the process of transmission is cumbersome as it requires submission of succession certificate / letter of probate / will, etc. Shareholders holding shares in single name and in physical form are requested to submit the prescribed Form SH-13 (in duplicate) to the secretarial department to avail of the nomination facility. Shareholders may contact the secretarial department for the said form. Shareholders holding shares in demat form are requested to contact their depository participants for availing the nomination facility.

Financial year:

The Company follows financial year starting from April 1 to March 31 each year.

Outstanding GDRs / ADRs / warrants:

The Company does not have any GDRs/ ADRs / Warrants or any convertible instruments.

Commodity Price Risks and Foreign Exchange Risks and hedging activities:

Being a housing finance company, the Company does not deal in the commodity market nor has any hedging activities. The Company has no exposure to foreign exchange borrowings.

Book Closure:

Pursuant to the provisions of Section 91 of the Companies Act, 2013 and Rule 10 of the Companies (Management and Administration) Rules, 2014, the register of members and share transfer books of the Company will remain closed from July 11, 2019 to July 19, 2019 (both days inclusive) for the purpose of AGM/Dividend for the financial year 2018-19.

Dividend Payment:

The Board of Directors of GRUH has recommended a dividend of 100 % (₹ 2 per share) for the financial year ended March 31, 2019 for approval of the shareholders at the annual general meeting.

Dividend entitlement is as follows:

- For shares held in physical form: shareholders whose names appear on the register of members of the Company as on Wednesday, July 10, 2019.

- For shares held in electronic form: beneficial owners whose names appear in the statement of beneficial position downloaded by NSDL and CDSL as at the relevant book close date.

Dividend, if declared by the members shall be paid on or after July 19, 2019 but within the statutory time limit.

33rd Annual General Meeting

| Date : | July 19, 2019 |

| Day : | Friday |

| Time : | 10.30 a.m. |

| Venue : | H.T. Parekh Convention Centre, Ahmedabad Management Association (AMA), ATIRA Campus, Dr. Vikram Sarabhai Marg, Vastrapur, Ahmedabad 380 015 |

Service Standards

GRUH is committed to providing effective and prompt service to its investors. The Secretarial Department has been entrusted with the responsibility of ensuring that the investors of the Company are serviced in accordance with the service standards. Listed below are the service standards adopted by the Company in respect of various services being rendered by the Secretarial Department.

| Nature of Service | Time Taken* |

| Transfer of shares | 10 working days |

| Issue of duplicate/re-validation of dividend warrant(s) | 7 working days |

| Change of address/ECS/Bank details | 7 working days |

| Registration of Nomination | 4 working days |

| Transmission of shares/Deletion of name | 10 working days |

| Split/Replacement/Consolidation of share certificate(s) | 10 working days |

* Subject to receipt and verification of valid documents and requisite approvals.

The investors are requested to contact the Secretarial Department for availing any of the said services. The Company has designated an exclusive e-mail address viz. investorcare@gruh.com which would enable investors to post their grievance.

A status report on adherence to the said service standards is reviewed by the Company secretary on a monthly basis and a detailed report is presented at the meetings of the Stakeholders Relationship Committee, for its review and noting.

Stock Market Data:

Monthly high and low quotations as well as the volume of shares traded at the BSE Limited and the NSE for 2018-19 along with the BSE Sensex and NIFTY are as follows:

BSE 2018-19 :

| Month | Highest (₹) | Lowest (₹) | Volume of Shares traded | BSE Sensex (monthly close) |

| April 2018 | 342.23 | 286.05 | 2006606 | 35160 |

| May 2018 | 368.00 | 317.80 | 3733890 | 35322 |

| June 2018 | 381.95 | 297.60 | 979082 | 35423 |

| July 2018 | 352.90 | 304.80 | 876588 | 37607 |

| August 2018 | 349.00 | 312.00 | 776436 | 38645 |

| September 2018 | 344.45 | 266.00 | 1037848 | 36227 |

| October 2018 | 306.00 | 244.10 | 967938 | 34442 |

| November 2018 | 309.60 | 275.05 | 590949 | 36194 |

| December 2018 | 334.65 | 275.00 | 820792 | 36068 |

| January 2019 | 329.00 | 204.60 | 11619455 | 36257 |

| February 2019 | 258.60 | 205.20 | 11406349 | 35867 |

| March 2019 | 288.55 | 248.15 | 10996699 | 38673 |

NSE 2018-19 :

| Month | Highest (₹) | Lowest (₹) | Volume of Shares traded | NIFTY (monthly close) |

| April 2018 | 342.45 | 286.10 | 16676400 | 10739 |

| May 2018 | 368.85 | 316.55 | 15853024 | 10736 |

| June 2018 | 382.00 | 297.60 | 11875237 | 10714 |

| July 2018 | 354.00 | 304.90 | 9835315 | 11357 |

| August 2018 | 349.55 | 310.70 | 13793814 | 11681 |

| September 2018 | 344.75 | 265.55 | 11761565 | 10930 |

| October 2018 | 306.30 | 244.05 | 12685365 | 10387 |

| November 2018 | 310.10 | 275.10 | 7242603 | 10877 |

| December 2018 | 335.40 | 275.10 | 9108314 | 10863 |

| January 2019 | 326.95 | 204.60 | 106116993 | 10831 |

| February 2019 | 259.00 | 204.80 | 28936406 | 10793 |

| March 2019 | 288.45 | 248.00 | 37428650 | 11624 |

* During FY 2018-19, Company has allotted bonus shars in the ratio of 1:1 number of shares and share price per share are adjusted to give effect of the bonus shares.

OTHER INFORMATION

Equity History:

| Particulars | No. of shares issued ( of ₹ 2 each ) |

Year / date |

| Subscription by Institutions | 1,00,00,000 | 1987 |

| Rights Issue | 50,00,000 | 1992 |

| Public Issue | 1,07,50,000 | 1992 |

| Reserved for allotment in Rights Issue (conversion of Part “A” of FCDs issued to GRUH Employees Welfare Trust) | 6,25,000 | 1994 |

| Rights Issue (conversion of Part “A” of FCDs issued to Shareholder(s) | 1,28,75,000 | 1995 |

| Reserved for allotment in Rights issue (conversion of Part “B” of FCDs issued to GRUH Employees Welfare Trust) | 12,50,000 | 1995 |

| Rights Issue (conversion of Part “B” of FCDs issued to Shareholder(s) | 2,57,50,000 | 1995 |

| Rights Issue (conversion of FCDs issued to Shareholder(s) | 6,62,50,000 | 1999 |

| Rights Issue | 3,97,50,000 | 2006 |

| Allotment under ESOS | 9,25,990 | 2006-07 |

| Allotment under ESOS | 62,505 | 2007-08 |

| Allotment under ESOS | 21,305 | 2008-09 |

| Allotment under ESOS | 3,65,950 | 2009-10 |

| Allotment under ESOS | 21,62,415 | 2010-11 |

| Allotment under ESOS | 7,25,025 | 2011-12 |

| Allotment under ESOS | 19,63,485 | 2012-13 |

| Allotment under ESOS | 16,54,475 | 2013-14 |

| Bonus Issue (1:1) | 18,01,31,150 | June 10 ’14 |

| Allotment under ESOS | 31,22,280 | 2014-15 |

| Allotment under ESOS | 2,97,160 | 2015-16 |

| Allotment under ESOS | 8,82,744 | 2016-17 |

| Allotment under ESOS | 11,55,527 | 2017-18 |

| Bonus Issue (1:1) | 36,57,20,011 | June 8 ’18 |

| Allotment under ESOS | 22,47,490 | 2018-19 |

| Total : (As At March 31, 2019) | 73,36,87,512 |

Note: The nominal face value of the equity shares of the Company was subdivided from ₹ 10 per equity share to ₹ 2 per equity share, with effect from July 26, 2012. Thereafter, at the 28th Annual General Meeting (AGM) of the Company held on May 28, 2014, the members of the Company had approved the issue of Bonus Shares in the proportion of 1:1 (i.e. one new fully paid up Equity Share of ₹ 2 each for every 1 (one) fully paid-up Equity Share of ₹ 2 each held. Again, at the 32nd Annual General Meeting (AGM) of the Company held on May 30, 2018, the members of the Company had approved the issue of Bonus Shares in the proportion of 1:1 (i.e. one new fully paid up Equity Share of 2 each for every 1 (one) fully paid-up Equity Share of ₹ 2 each held. Accordingly, for ease of comparison, all issues have been represented by equity shares of ₹ 2 each

Measuring Shareholders’ Value :

At GRUH, we beliveve in maximizing the wealth of its shareholders and our endeavours are in the direction of providing maximum value to our shareholders either in the form of dividend or capital appreciation. The value of shareholders’ return is measured as follows :

A. Total Shareholders’ Return :

Total Shareholders’ return includes the dividend paid by the Company as well as the capital appreciation of the shares of the Company in the stock markets. During the past five years return to shareholders has been as follows :

(₹ in crores)

| Particulars | 2018-19 | 2017-18 | 2016-17 | 2015-16 | 2014-15 |

| Closing Market Capitalisation | 20,235.10 | 21,038.04 | 14,433.11 | 8,701.09 | 8,866.58 |

| Opening Market Capitalisation | 21,038.04 | 14,433.11 | 8,701.09 | 8,866.58 | 5,319.27 |

| Money raised during the year from Shareholders | 30.15 | 31.00 | 22.57 | 1.01 | 10.56 |

| Net Capital Appreciation | (833.09) | 6,573.94 | 5,709.45 | (166.50) | 3,536.75 |

| Dividend including Dividend Tax | 176.90 | 145.50 | 123.00 | 100.68 | 87.48 |

| Total Gain | (656.19) | 6,719.44 | 5,832.45 | (65.82) | 3,624.23 |

| Gain to Opening Market Capitalisation (%) | (3.12) | 46.56 | 67.03 | (0.74) | 68.13 |

B. Enterprise Value :

Enterprise Value (EV) measures the value of a Company as on a particular date. It is calculated by making adjustments to the market capitalisation of a Company. The formula for measuring Enterprise Value is :

Enterprise Value (EV) = Market Capitalisation + Total Debt – Cash Balance

With the Enterprise Value as a measure, the companies can be compared easily irrespective of their capital structure. Moreover, Enterprise value is used to calculate the ratio of EV to EBIDTA multiple.

EBIDTA stands for Earnings before Interest, Depreciation, Tax and other appropriations. Hence, it can be calculated by adding back the figures of interest, depreciation and other appropriations to the amount of Profit Before Tax (PBT). It indicates that the value of enterprise is equal to number of times of the Company’s earnings. As the figures of Interest, depreciation and tax are added back, it makes the comparison between two enterprises easier by eliminating all the accounting and tax differences.

The above measure for GRUH for a period of five years is as follows : –

(₹ in crores)

| Particulars As At March 31, | 2019 | 2018 | 2017 | 2016 | 2015 |

| Number of Equity Shares of ₹ 2 each (crores)* | 73.37 | 73.14 | 72.92 | 72.74 | 72.68 |

| Market Price per share on face value of ₹ 2 each* | 275.80 | 287.63 | 197.95 | 119.63 | 122.00 |

| Market Capitalisation | 20,235.10 | 21,038.04 | 14,433.11 | 8,701.09 | 8,866.59 |

| Total Debt | 16,507.16 | 13,968.93 | 12,018.15 | 10,244.4 | 8,215.58 |

| Cash | 1052.84 | 17.47 | 12.56 | 27.45 | 8.30 |

| Enterprise Value(EV) | 35,689.42 | 34,989.50 | 26,438.70 | 18,918.04 | 17,073.87 |

| EBIDTA | 1,919.65 | 1,555.04 | 1,364.48 | 1,172.14 | 979.86 |

| EV/ EBIDTA (times) | 18.59 | 22.50 | 19.38 | 16.14 | 17.43 |

| Total Income | 2,026.65 | 1,693.74 | 1,487.39 | 1,275.40 | 1,060.32 |

| EV / Total Income (times) | 17.61 | 20.66 | 17.78 | 14.83 | 16.10 |

*During FY 2018-19 and FY 2014-15, Company has allotted bonus shares in the ratio of 1:1. Number of shares and share price per share of previous years are adjusted to give effect of Bonus shares. Market price on the stock exchange where maximum numbers of shares have been traded is considered.

During FY 18-19, GRUH adopted Ind AS where figures for FY 17-18 are restated under Ind AS. Figures up to FY 16-17 are as reported under Indian GAAP.

Web links:

As required under the various provisions of the Companies Act, 2013 and SEBI (LODR) Regulations, 2015, the web link of some of the important documents placed on the website of the Company is provided below: